Intuitive Workflow and Collaboration Automation Simplifies Steps Financial Services Institutions Must Take to Stay Compliant and Lower Compliance Risk

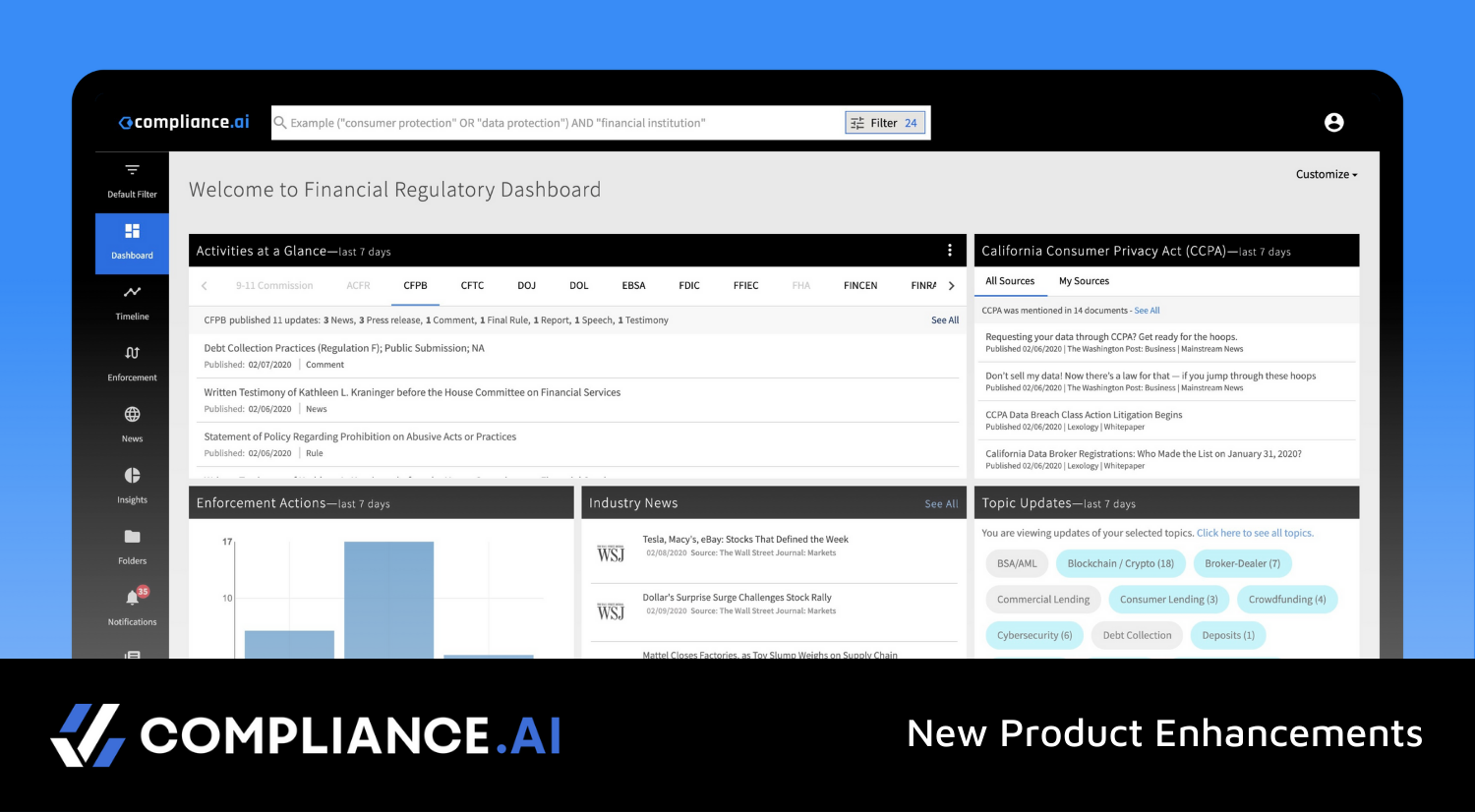

WASHINGTON, Nov. 07, 2018 (GLOBE NEWSWIRE) — Today at RegTech Enable, Compliance.ai announced the general availability of its Workflow Automation solution, part of the Team Edition financial regulatory change management platform. A RegTech pioneer, Compliance.ai’s modern SaaS platform enables Chief Compliance Officers and their teams to cost-effectively manage the growing volume and velocity of regulatory changes in near real-time without increasing headcount.

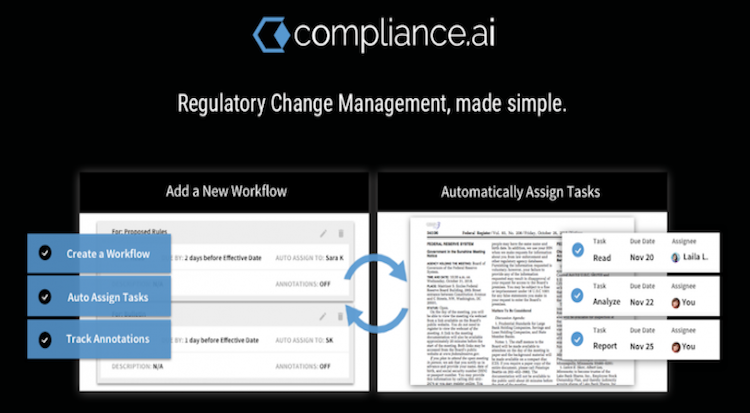

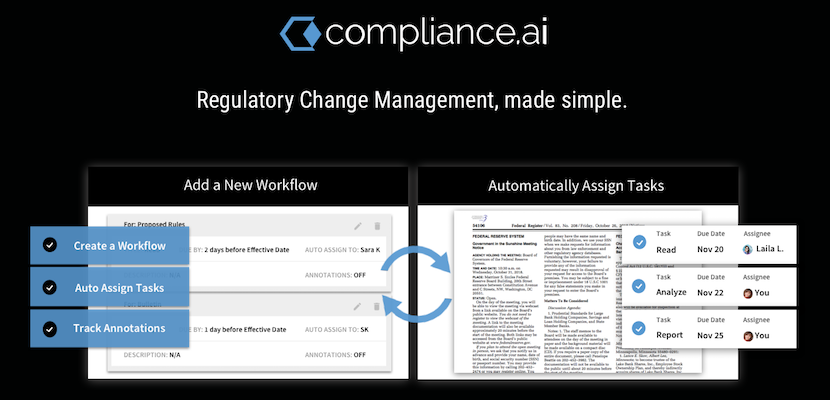

Compliance.ai’s Team Edition provides a simple, centralized way for financial compliance teams to collaborate on tasks, actions, and prioritization of deadlines, with dependencies across business departments. Workflow Automation improves collaboration across stakeholders by creating automatic to-do lists that guide team members through the change management process based on regulatory changes relevant to them, across various jurisdictions, while also intelligently assessing risks. The new Workflow capability integrates with existing GRC systems, including risk assessment tools, to significantly lower the time it takes to assign and manage tasks.

The new solution comes to market as financial services institutions of all sizes are seeking modern, scalable regulatory technologies that are designed for today’s needs. This growth is fueled by the exponential increase in regulatory changes over the past decade, from an average of 10 regulatory changes a day to an average of 200 a day. This dynamic regulatory environment has compliance teams spending on average 20-30 percent of their day reactively chasing regulatory content, much of which is not relevant to them.

“Chief Compliance Officers are tasked with managing a massive increase in the volume and complexity of regulatory changes–and the consequences for not complying include huge financial fines and reputational damage–yet, banks often don’t have the resources or technology to efficiently keep track of and comply with the regs they need to,” said Kayvan Alikhani, CEO of Compliance.ai.